[Press Release] Honoring award-winning enterprises Vietnam Listed Company Awards 2024

Da Lat City, November 16, 2024 — Forty-four outstanding listed companies were honored for their information transparency at the 17th Vietnam Listed Company Awards (VLCA) 2024 ceremony held at Merperle Dalat Hotel.

The event which was held in conjunction with the 2024 Annual Listed Company Conference, witnessed the participation of leaders of the State Securities Commission, two stock exchanges, Vietnam Securities Depository and Clearing Corporation and representatives of nearly 300 listed enterprises, securities companies, fund management companies and other financial institutions in Vietnam.

Entering its 17th year, VLCA 2024 continued to affirm its position as a prestigious award in the business community and the Vietnamese stock market. It not only honored listed companies with outstanding efforts in reporting and disclosing information, implementing regulations and good practices on governance, good practices on Environmental, Social, and Governance (ESG), but also served as a foundation to encourage enterprises to ensure advanced governance standards, information transparency and sustainable development. After nearly 6 months of evaluation, among over 500 listed enterprises on two stock bourses, the Judging Panel selected 44 excellent enterprises in 3 categories of Annual Report, Corporate Governance and Sustainability Reporting honor (See attached list of winners).

For the Annual Report category:

2024 was the second year that VLCA opened for registration in this category. This year, 96 listed enterprises registered and were eligible to participate. The voting council decided to recognize the 30 best enterprises, including 10 financial enterprises and 20 non-financial enterprises.

The evaluation criteria continued to be implemented by the Ministry of Finance’s Circular No 96/2020/TT-BTC dated November 16, 2020, guiding information disclosure on the stock market.

The average score was 72.16 points, marking a slight increase of about 5.19% compared to 2023. Most of the annual reports scored from 70 – 90 points. Notably, the rate of enterprises with reports scoring from 80-90 points this year increased significantly compared to last year. Thereby, this year’s edition saw even quality level among annual reports registered despite a decrease in quantity.

For the finance group, the number of reports participating in the evaluation did not fluctuate, and the average score was 74.32 points (up 2.30% compared to 2023), the highest score was 93.79 points (up 3.44% compared to 2023).

For the non-financial group, with the number of reports decreasing, the average score was 71.39 points (up 5.70% compared to 2023), the highest score was 93.41 points (up 2.70% compared to 2023).

Financial enterprises focused on risk disclosure, risk management models, bad debt assessment and effective capital use. Meanwhile, non-financial enterprises stood out with sustainable development initiatives such as energy saving, resource management and material reuse. This reflected the business characteristics and long-term development goals of each industry group.

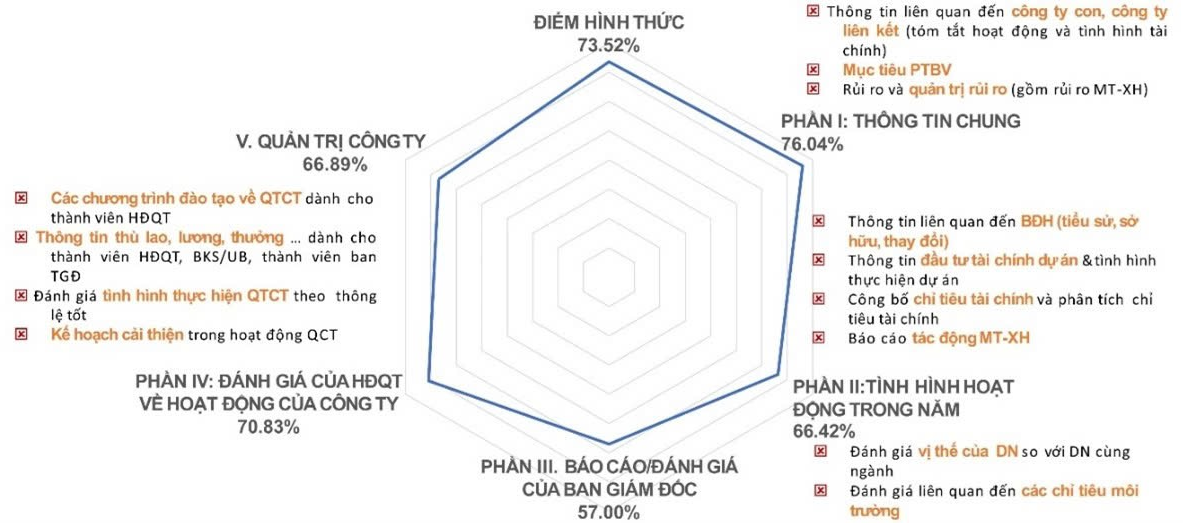

Annual Report Assessment Results – VLCA 2024

(Source: VIOD results report – preliminary round scoring unit)

The preparation of annual reports in English still had limitations. In 2024, 36 out of 96 participating enterprises had annual reports in English, accounting for 37.50% of the total number of reports evaluated. The number of English reports this year decreased by 2 reports over 2023. However, the ratio of English annual reports saw a slight rise compared to that of last year when there were 38 out of 116 English annual reports, accounting for 32.76%.

2024 was the second year that the annual report evaluation criteria set comprised a mandatory question on the disclosure of information on the company’s environmental impact. This year, the number of reports mentioning solutions to reduce greenhouse gas emissions decreased slightly compared to last year due to the drop in the number of participants.

However, the ratio of reports disclosing this content to the total number of participating reports increased, showing that many participating enterprises have paid attention to presenting environmental and social content in their annual reports to convey corporate information to shareholders and investors.

In addition, the results also showed many weaknesses that needed to be improved. Regarding corporate governance content, most enterprises complied with disclosing information according to the law rather than voluntarily applying best practices in corporate governance.

In terms of the business performance during the year, many reports failed to have a clear presentation of the position of the enterprise and assessments related to environmental indicators. The report/assessment section of the board of directors remained incomplete. Information on the social environment of the community, sustainable development goals, and others on greenhouse gas emissions was still limited. The number of enterprises with annual reports in English has not increased compared to that of the previous years.

In terms of the Corporate Governance (CG) category:

107 enterprises with the best corporate governance were selected for the final round, divided by capitalization group. Of these, 37 enterprises were in the large-cap group, 34 enterprises were in the mid-cap group and 36 enterprises were in the small-cap group. In the final round, the Judging Council selected the 26 winners.

2024 marked a major change in the evaluation of the CG award, by updating the set of questions according to the latest practices (G20/ Principles of CG October 2023), and changing the scoring structure towards increasing the proportion of practice points to 40% (instead of 30% as in previous years), and reducing the compliance score from 70% to 60%, to encourage enterprises to apply more international practices on CG, raising governance standards beyond compliance.

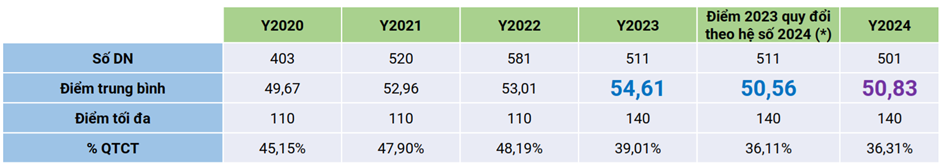

The set of criteria for assessing corporate governance was built on two levels. Firstly, complying with current Vietnamese laws on corporate governance for public companies. Secondly, applying good corporate governance practices. In 2024, with the change in the scoring structure, there was also a change in the scores of enterprises:

(Source: VIOD results report – preliminary round scoring unit)

Among the finalists, the CG assessment results did not show a significant difference between the large- and mid-cap groups. However, compared to the small-cap group, this gap was more pronounced, as shown by the average scores of the large- and mid-cap groups.

The final results honored 26 enterprises thanks for their excellent governance practices, demonstrating their significant efforts in improving governance efficiency.

Among the 26 awarded enterprises, large-cap enterprises still had outstanding results compared to the other two groups, and the small-cap group needed to make greater efforts to to catching up with the two groups in perfecting corporate governance practices and disclosure.

A notable highlight of 2024 was the 40% increase seen in the number of enterprises preparing and publishing their sustainable development reports (SDRs) by international standards such as GRI, Integrated Reporting, SASB, and ISSB (TCFD integrated), compared to 2023.

When applying these international reporting standards, enterprises disclosed key ESG topics linked to the organization’s core strategy, with the participation and contribution of internal and external stakeholders.

Notably, a significant proportion of enterprises had sustainable development issues monitored by a board committee or designated board members. The boards of the winning enterprises took the lead in setting sustainable development goals and the process of evaluating implementation results.

The efforts to ensure governance and transparency of the enterprises honored in VLCA 2024 not only contributed to improving their corporate governance but also affirmed their pioneering role in promoting the sustainable development of the Vietnamese stock market. A strong commitment to international standards on ESG and corporate governance laid an important foundation for enterprises to develop, increase their reputation, and attract the attention of domestic and foreign investors.

In addition, there remained many shortcomings that enterprises needed to improve, especially in terms of the role of stakeholders. This year, when the corporate governance criteria were updated to promote the application of Good Practices, the questions on environmental and social impact disclosure through policies and practices with stakeholders, disclosure and practice of Codes of Ethics were important contents, increasing the proportion of scoring points. However, the results showed that enterprises had not achieved good scores in these questions.

An improvement in “Shareholder rights” content was also needed. Enterprises were urged to update the method of organizing the General Meeting of Shareholders, and apply modern technology such as online meetings or electronic voting to facilitate shareholders to attend and vote, ensuring the rights of small shareholders.

Meanwhile, there were few enterprises drafting documents for the General Meeting of Shareholders in English. Regarding the Board of Directors, not many enterprises disclosed information on gender balance policies and diversity in composition. The number of enterprises with the Chairman of the Board of Directors being an independent member was also limited.

For the Sustainability Reporting category:

In 2024, businesses with sustainable development reports and those registered to participate in the sustainability reporting category were evaluated. The evaluation criteria changed to promote businesses to implement a more comprehensive and transparent sustainable development strategy compared to 2023. The number of criteria rose by 46 criteria in 2024 from 44 criteria in 2023. Two criteria on stakeholder participation and corporate social responsibility were added.

An overview of this year’s sustainability reporting category showed clear progress in quantity and quality. In addition to maintaining the position of well-known businesses, many new ones were appreciated for their reports’ structure in the first year of implementation.

The number of companies preparing separate sustainable development reports this year witnessed a record hike from 21 to 33, continuing the increase over the years. 2024 was also a year that saw the highest number of sustainable development reports and the highest quantity of reports entering the final round in the past 12 years. This reflected greater attention of businesses to disclosing sustainable development reports. At the same time, the efforts of management agencies in encouraging businesses to prepare sustainable development reports were also recognized.

Financial services organizations always archived the top awards and overwhelming in the categories of annual reports and corporate governance in previous years, but not for sustainable development reports. In previous years, there were usually only 2-3 reports in the financial services industry prepared separately, accounting for about 10% of the total number of reports. However, out of the 33 separated sustainable development reports evaluated this year, 10 or nearly 30% of the total were prepared by financial services companies, including six from banks, two from insurance firms and two from financial and securities enterprises.

Participating enterprises continued to apply international standards in their sustainable development reports. Besides GRI, some companies also applied other reporting frameworks such as CDP, SASB and SDG. The number of firms that applied the ESG Committee model also rose positively.

In addition, the issue of biodiversity was also mentioned in the reports of some companies. The number of companies setting targets on greenhouse gas emissions and reporting at scope 1 and 2 increased significantly. Accordingly, two out of three finalists published data on greenhouse gas emissions.

This year, the average score for greenhouse gas emissions rose compared to 2023. Notably, two enterprises – VNM and STK – set emission targets according to SBTi.

However, there were still some limitations that needed to be improved. For example, some enterprises failed to maintain the quality of their reports as in previous years while some others still referred to the old GRI standards and most of them referred to these standards instead of complying with them.

The application of reporting frameworks, especially the sectoral framework, remained limited. Meanwhile, most participating enterprises lacked SMART targets. The data collection process for reporting was not clearly stated and it lacked analysis and comparison; the scope of assurance was insufficient, resulting in unreliable information. Especially, few enterprises had independent assurance for greenhouse gas emission targets.

Tran Anh Dao, Acting CEO in charge of the Board of Management of Ho Chi Minh Stock Exchange cum Chairwoman of the VLCA 2024 Voting Council, said that Vietnam is on the path to improving corporate governance with the desire to become one of the five countries with the best corporate governance system in the ASEAN region. This is not only an important goal and strategy but also a foundation for Vietnam to enhance its competitiveness, attract foreign investment and create a positive image in the eyes of the international financial community.

“Towards this goal, VLCA does not stop at voting and honoring. We aim to elevate the position of Vietnamese listed companies by promoting advanced governance initiatives, encouraging businesses to make commitments in applying good practices, thus contributing to building a strong financial market.”

“To do this, we call for a joint effort with an overall strategy and coordinated implementation from the business community, management agencies, and market partners to improve business quality and market quality,” Dao said.

“One of the key factors that helps Vietnam improve its ranking in the ASEAN region is the application of international governance standards. Through the corporate governance category, VLCA continues to encourage businesses to apply OECD governance principles and best practices from developed markets.”

“These standards help businesses ensure shareholder rights, increase transparency in operations, improve their competitiveness and create trust for investors, especially foreign investors,” Dao said.

The Vietnam Listed Company Awards (VLCA) is evolved from the Annual Report Awards. Jointly organized by the Ho Chi Minh Stock Exchange (HoSE), the Hanoi Stock Exchange (HNX), and Dau Tu Newspaper, the VLCA is solely sponsored by Dragon Capital Vietnam Management Company. It is technically supported by professional partners including International Finance Corporation (IFC), Association of Chartered Certified Accountants (ACCA), Vietnam Institute of Directors (VIOD) and leading audit companies like Deloitte Vietnam Co., Ltd, Ernst & Young Vietnam Co., Ltd, KPMG Vietnam Co., Ltd and PwC Vietnam Co., Ltd. The award is also received the information supports from the State Securities Commission and two stock exchanges. The results of the VLCA 2024 have affirmed the accuracy and objectivity in the evaluation process.

2024 is the 17th year that the award has accompanied the Vietnam’s stock market and the listed business community.

—————————-

For more information about the award, please visit the website (www.aravietnam.vn), the website of HOSE (www.hsx.vn), HNX (www.hnx.vn) or Securities and Investment Newspaper (www.dtck.vn), or contact:

Mrs. Tran Anh Dao

Acting CEO in charge of the Board of Management of Ho Chi Minh Stock Exchange

Tel: 08-3821 7713

Email: anhdao@hsx.vn

Mr. Nguyen Hong

Deputy Editor-in-Chief

Investment Newspaper

Tel: 0903 684 558

Email: nguyenhong@virhcm.com.vn

![[Press Release] Winners of 2023 Vietnam Listed Company Awards honored](https://vlca.vn/wp-content/uploads/2024/10/10-scaled.jpg)

![[Press Release] Best listed companies in Vietnam in 2022 recognized](https://vlca.vn/wp-content/uploads/2024/10/9-1-scaled.jpg)

![[Press release] A virtual ceremony to honor best-listed enterprises in Vietnam in 2021](https://vlca.vn/wp-content/uploads/2021/12/76-nguon-rau-sach-anh-hien-thuc-Phamphuocdl1967@gmail.com_.jpg)